unrealized capital gains tax yellen

John Neely Kennedy R-LA said a proposed unrealized capital gains tax will affect millions and millions of middle-class Americans and maul the real-estate market and the market for other long-term assets while appearing on Tucker Carlson Tonight Thursday. Let me unravel what unrealized capital gains means through an illustration.

Lorde Edge And Unrealized Gains Tax No Safe Bets

Jan 22 2021 - 204am.

. Lets say the government through insanely reckless spending and money printing causes inflation and just for good measure artificially shuts down the economy for a year and throws millions of people out of work. The exact magnitude of the capital gain is 2000 gross proceeds minus 1000 cost basis resulting in a long term capital gain of 1000. This profit is a capital gain.

Yellen made the remarks in response to a question from Tapper about whether a wealth tax should be part of how Democrats look to pay for Bidens 35. You get taxed on 100 of any gain but capped at 3000 loss. October 24 2021 1056 PM.

Get News People and Transactions Delivered to Your Inbox. For example perhaps you purchased a house at 300000 and sold it for 350000. Yellen said lawmakers are considering a billionaires tax to help pay for Bidens social safety net and climate change bill.

Secretary Janet Yellen has been discussing in various media the Biden administration is now revealing an unrealized capital gains tax from stocks and bonds. Eagle-Keeper January 21 2021 951pm 1. For example suppose at the end of the year Im sitting on 11M in Tesla with a basis of 1M.

The Wyden plan by contrast would tax only the unrealized gain a billionaire family had but the long-term capital gains rate is 20 percent. There is a principle in taxation that has been long-standing practice in the United States that financial wherewithal is key to a tax being owed. Their last fiscal resort is taxing unrealized capital gains of billionaires Journal Editorial Report.

The Wyden plan by contrast would tax only the unrealized gain. An unrealized capital gains tax would violate this. Government coffers during a virtual conference hosted by The New York Times.

Governments are always evil. Ron Wyden D-Oregon would impose an annual. Say that you own a home worth 150000.

The United States Treasury Secretary Janet Yellen has announced the proposal of a new tax that could hit unrealized capital gains. If you still owned the house when it was valued at 350000 as opposed to selling it you would have grossed. In other words if a transaction occurs in which a tax payer does not have the funds to pay a tax generally wouldnt be owed.

A 2 drawdawn on your unrealized capital gains requires people to have set aside cash for that very tax purpose. It is the theoretical profit existent on paper. Senator Warren advocated a 3 percent tax for billionaires for example.

Suppose the rule is to tax 10 of the unrealized. Tags capital could gains means proposes unrealized yellen Post navigation The largest Amish community in the US. Capital gains tax is a tax on the profit that investors realize on the sale of their assets.

Secretary of the treasury Janet Yellen discussed the subject on CNN. Yellen had first proposed the tax on unrealised capital gains in February 2021. Not exactly sure how that would work especially if the next year the stock price drops below what you paid for it.

The unsold wealth of the super rich are often transferred. The phrase unrealized capital gains has been trending on social media and forums during the last 24 hours after the US. Treasury Secretary Janet Yellen told CNNs Jake Tapper on Sunday that Senate Democrats are considering a proposal to impose a tax on unrealized capital gains of the wealthiest Americans.

So I pay say 20 tax on the 10 of my 10M in unrealized gains just 200k. The new Billionaire Income Tax is being written by Senate Finance Committee Chairman Ron Wyden Democrat. Treasury Secretary Janet Yellen explained on CNN Sunday that the proposal raised by Sen.

Unrealized capital gains refer to the. Speaking on CNNs. Nobut if you lose almost all of it and it goes back up those will be gains that are taxed.

It goes against the concept of taxing income because thats a tax on generated cash flow whereas there is no generated cashflow in this event and theres still a tax on it. Earlier in 2021 Yellen proposed taxing unrealized capital gains to boost US. Unrealized capital gains put simply is the increase in the value of an asset that has yet to be sold.

Taxing unrealized capital gains is not practical and will hurt sentiment among investors said Howard Marks co-chairman and co-founder of Oaktree Capital. Senior Democrats confirmed that a proposal to tax billionaires unrealized capital gains will likely be included in President Bidens 2 trillion spending packageTreasury Secretary. I tend to like the idea that a certain portion of unrealized cap gains must be added to basis and taxed each year.

Would you then get. Defeated Covid without lock downs without vaccines and without closing churches. The plan will be included in the Democrats US 2 trillion reconciliation bill.

Total long term capital gain rate 567. There is also something called the Net Investment. It looks like Janet Yellen would like to tax unrealized capital gains.

Janet Yellen the Treasury Secretary in the Joe Biden administration has proposed taxing unrealised capital gains. The weeks best and worst from Kim. Since then many wealth managers from Howard Marks to Peter Mallouk as well as many others have argued that this.

US Treasury Secretary Janet Yellen has proposed a tax on unrealised capital gains of billionaires. If you are in the top tax bracket your long-term capital gains tax rate would be 20 of 200 on your 1000 profit.

Tax On Unrealized Capital Gains Proposal By Janet Yellen Exponential Age Youtube

An Act Of War Against The Middle Class Americans Criticize Janet Yellen S Idea To Tax Unrealized Capital Gains Buyucoin Blog

An Unrealized Capital Gains Tax Would Wallop Big Stock And Bitcoin Investors Nasdaq

Democrats Terrible Idea Taxing Profits That Don T Exist

Janet Yellen Unveils Proposal To Tax Unrealized Dreams

No U S Won T Tax Your Unrealized Capital Gains Alexandria

Us Government Unrealized Gains Tax Plans Might Hit Crypto Billionaires Too

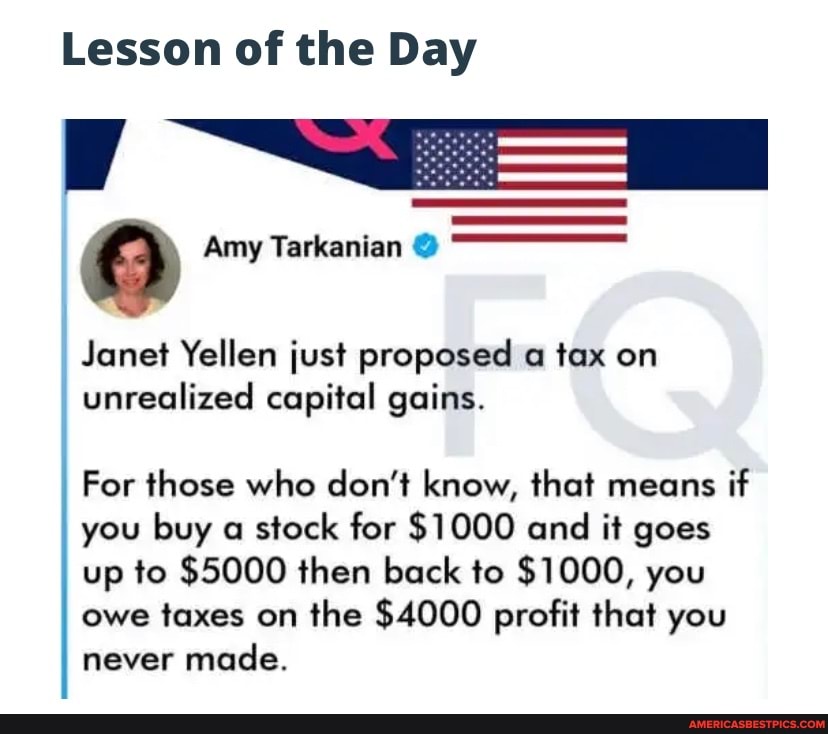

Lesson Of The Day Amy Tarkanian Janet Yellen Just Proposed A Tax On Unrealized Capital Gains

Nancy Pelosi Says A Wealth Tax On Billionaires Unrealized Gains Is On The Way Mish Talk Global Economic Trend Analysis

Best Argument Against Unrealized Capital Gains Tax Janet Yellen Capital Gains Tax Youtube

Does Treasury Secretary Yellen Really Want Unrealized Capital Gains To Be Treated As Income Swfi

Cryptowhale On Twitter Us Treasury Secretary Janet Yellen Suggests Imposing A Tax On Unrealized Capital Gains This Means Stock Gains Will Be Taxed Even When They Have Not Been Sold It Also

Why The Fed Needs Janet Yellen To Steal W Unrealized Capital Gains Avoiding Taxes W Roth Iras Youtube

Janet Yellen Favors Higher Company Tax Signals Capital Gains Worth A Look Business Standard News

Us Lawmakers Float Tax On Billionaires Unrealised Capital Gains The Market Herald

Sam Bankman Fried Takes Down Janet Yellen With Insanely Sensible Tweets

Uzivatel Bq Prime Na Twitteru Yes Taxation Of Unrealised Stock Market Gains Seems Unusual But It Is Already Embedded In The System Argues Shankkaraiyar Calling For A One Time Tax On Billionaires He