child tax credit december 2021 amount

Get your advance payments total and number of qualifying children in your online account. Ages five and younger is up to 3600 in total up to 300 in advance monthly Ages six to 17 is up to 3000 in total up to 250 in advance monthly Additionally a portion of your amount is reduced by 50 for every 1000 over certain income limits see the FAQs below.

Child Tax Credit 2021 8 Things You Need To Know District Capital

3600 for children ages 5 and under at the end of 2021.

. The IRS says that eligible families who didnt get any CTC payments can claim the full amount on their 2021 federal tax return. Instead of calling it may be faster to check the. This is up from the 2020 child.

A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive. The American Rescue Plan increased the amount of the Child Tax Credit from 2000 to 3600 for qualifying children under. Here is some important information to understand about this years Child Tax Credit.

Children under 6 years old qualify for the full enhanced Child Tax Credit of 3600 if their single-filer parent earns less than 75000 or their. The maximum Child Tax Credit increased to 3600 for children under the age of 6 and to 3000 per child for children between ages 6 and 17. 7 hours agoInitially families received the child tax credit monthly payments of 300 or 250 from July to December 2021.

The IRS has not announced a separate phone number for child tax credit questions but the main number for tax-related questions is 800-829-1040. For 2021 only the child tax credit amount was increased from 2000 for each child age 16 or younger to 3600 per. The two most significant changes impact the credit amount and how parents receive the credit.

The Child Tax Credit provides money to support American families. The credit amount was increased for 2021. The child tax credits are worth 3600 per child under six in 2021 3000 per child aged between six and 17 and 500 for college students aged up to 24.

Families will receive the other half when they submit their 2021 tax return next season. Box 1 which is at the very top of this letter will tell you the total dollar amount of money you received for the advance child tax credit payments over six months in 2021. First the credit amount was temporarily increased from 2000 per child to 3000 per child 3600.

Child Tax Credit Amount for 2021 The American Rescue Plan Act of 2021 raised the amount of the child tax credit to 3000 per child or 3600 per child under age 6. In 2021 this tax credit was increased to provide a maximum of 3600 per qualifying dependent for ages 0 to 6 and a maximum of 3000 per qualifying dependent for. For example monthly payments could be up to 250 per qualifying child 300 per qualifying child under age 6.

Specifically the Child Tax Credit was revised in the following ways for 2021. For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to. To reconcile advance payments on your 2021 return.

However theyre automatically issued as monthly advance payments between July and December -. You need to enter that amount on Schedule 8812 called Credits for Qualifying Children and Other Dependents on line 14f or line 15e whichever applies. The next child tax credit check goes out Monday November 15.

You have a balance of 6900 for your older children plus 3600 for the newborn which makes a total of 10500. Child tax credit for baby born in December 21 The total child tax credit of 10500 is correct. The credit amounts will increase for many taxpayers.

For families with children under 6. And 3000 for children ages 6 through 17 at the end of 2021. For 2021 eligible parents or guardians can receive up to 3600 for each child who was under 6 years old at the end of 2021 and up to 3000 for.

Treasury will make the payments between July and December 2021. The payment for children. However theyre automatically issued as monthly advance payments between July and December - worth up to 300 per child.

If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. The rest of the 3600 and 3000 amounts should have been claimed when parents filed. For 2021 the child tax credit amount increases from 2000 to 3000 per qualifying child 3600 per qualifying child under age 6.

The American Rescue Plan Act ARPA of 2021 made important changes to the Child Tax Credit CTC for tax year 2021 only. If you and your family meet the income eligibility requirements and you received each advance payment between July and December 2021 you can expect to receive up to 1800 for each child age 5 and. The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600 per qualifying child.

December 15 2021. In total the expanded credit provides up to 3600 for each younger child and up to 3000 for each older. Enter your information on Schedule 8812 Form.

How Much Were the Child Tax Credit Payments Each Month. The child tax credits are worth 3600 per child under six in 2021 3000 per child between six and 17 and 500 for college students aged up to 24.

Your Financial Plan Reviewing 2020 Making Plans For 2021 Katehorrell Financial Planning How To Plan Financial

What Families Need To Know About The Ctc In 2022 Clasp

The Final Child Tax Credit Payment Of 2021 Is Here Is It The Last One Ever Here S What Happens Next Marketwatch

Child Tax Credit 2022 How Much Of Your Ctc Payment Is Expected In Your Refund Marca

Child Tax Credit 2021 8 Things You Need To Know District Capital

Irs Child Tax Credit Money Don T Miss An Extra 1 800 Per Kid Cnet

2020 Reverse Tax Credit Available For Filing Barbados Today In 2021 Tax Credits Reverse Tax

People Have Already Received Their 300 Per Child Tax Payment Here S How To Check On Yours

Public Notice Update Banking Information To Get Reverse Tax Credit Barbados Today Tax Credits Motivational Skills Banking

The 2021 Child Tax Credit For Expats Are You Eligible Greenback Expat Tax Services

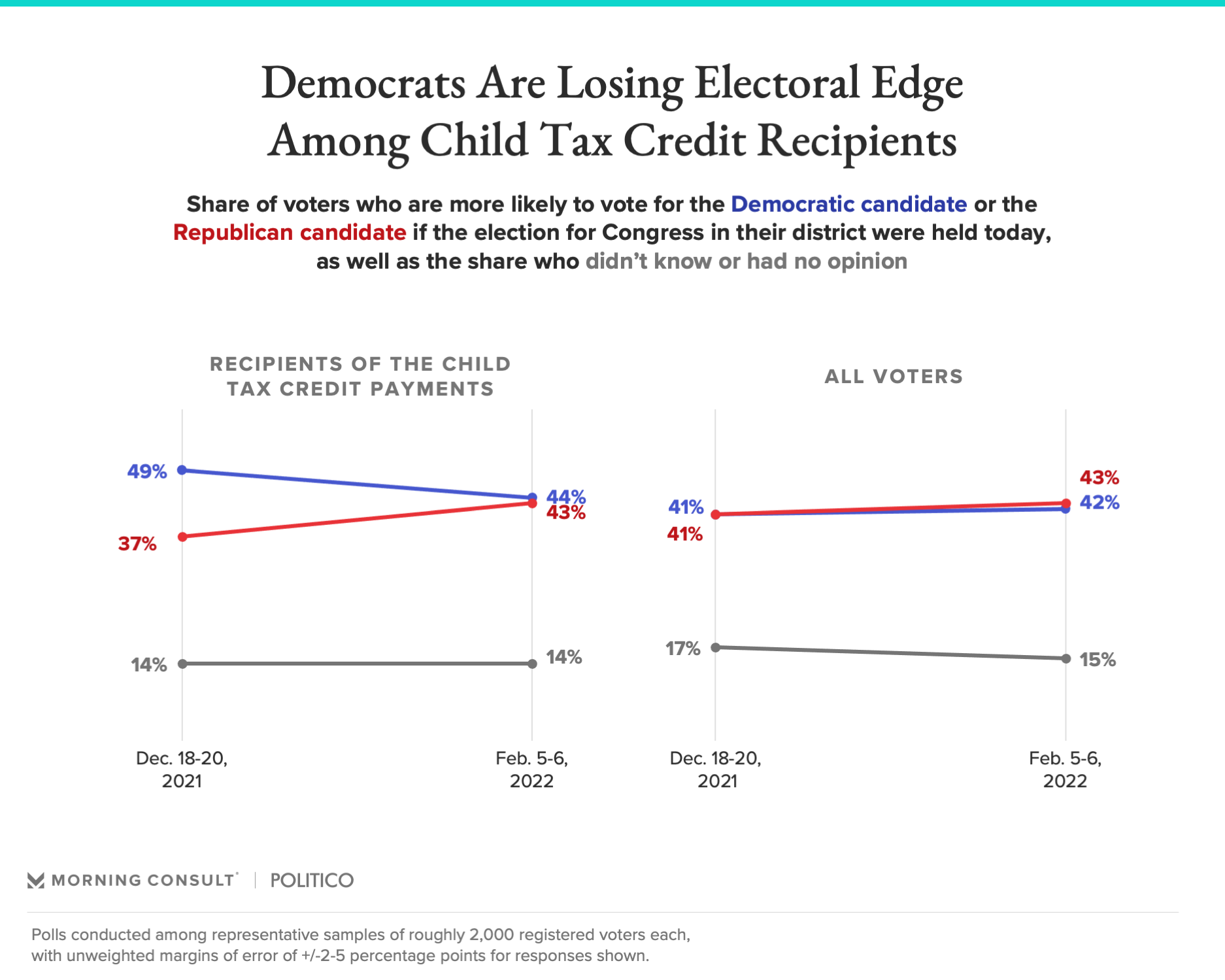

Gauging The Impact Of The Expanded Child Tax Credit S Expiration

Help Is Here The Expanded Child Tax Credit Congressman Emanuel Cleaver

First Month Without The Expanded Child Tax Credit Has Left Families In Distress Npr

Parents Guide To The Child Tax Credit Nextadvisor With Time

2021 Child Tax Credit Advanced Payment Option Tas

Always Keep Employee Td1 S Up To Date Tax Credits Hiring Employees New Bus

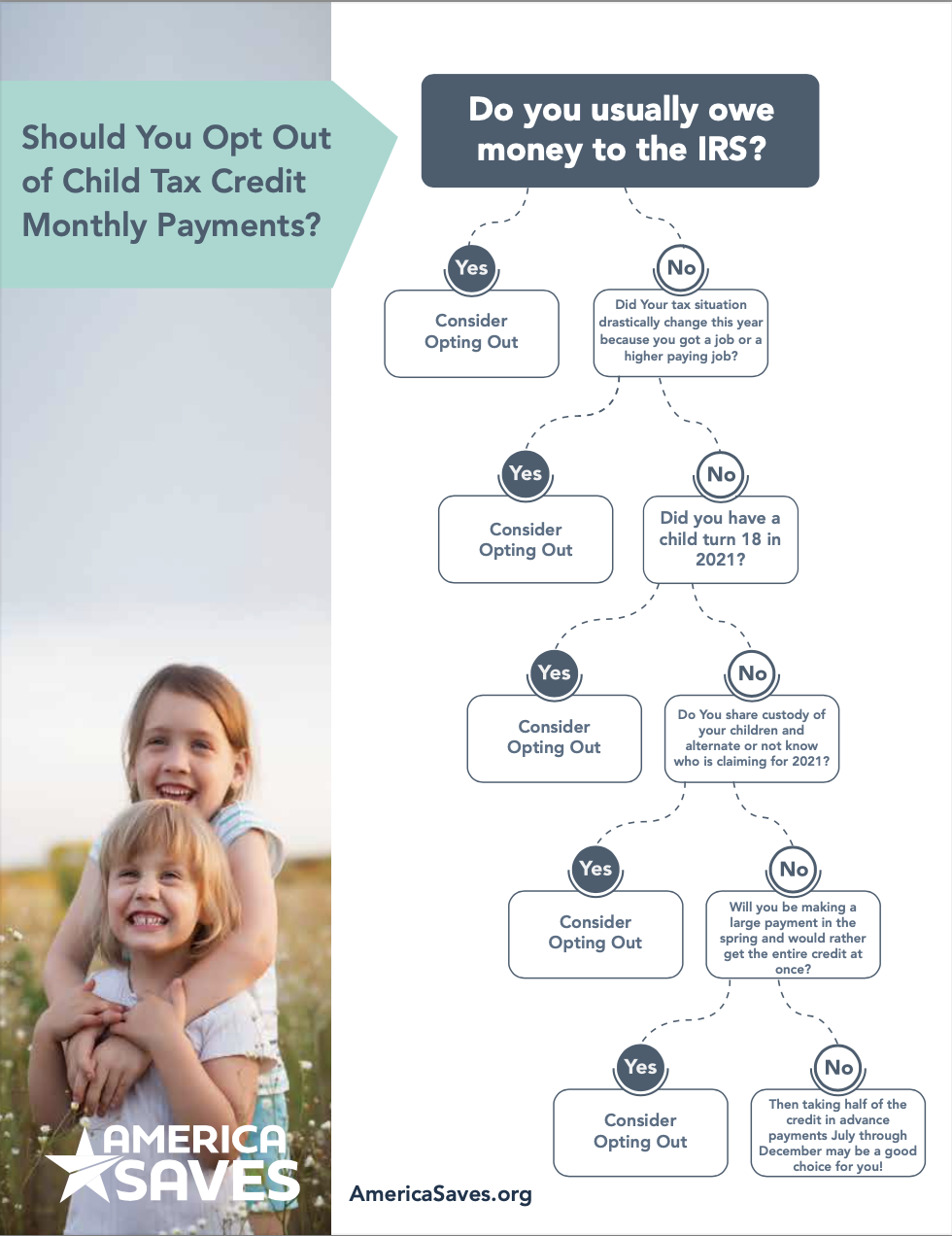

What You Need To Know About The 2021 Child Tax Credit Changes America Saves

Child Tax Credit Is December The Final Check Deseret News

Gauging The Impact Of The Expanded Child Tax Credit S Expiration